Why does a stock market crash happen

The Trading Deck features opinions on trading and investing written by market professionals, not staff journalists. Gayed, CFA, winner of the Dow Awardis chief investment strategist and co-portfolio manager at Pension Partners, LLC.

5 reasons why the market won't crash - The Buzz - Investment and Stock Market News

From toGayed was a strategist at AmeriCap Advisers LLC, a registered investment advisory firm that managed equity portfolios for large institutional clients. Follow him on Twitter pensionpartners and YouTube youtube. It's actually the biggest distortion and lie.

Stock market crash - Wikipedia

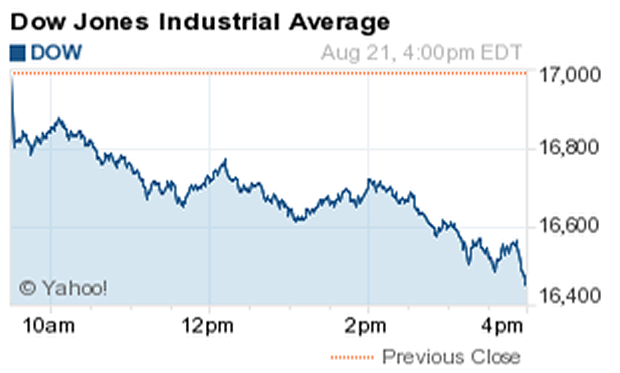

In fact, staying asleep is what's killing us. October tends to be one of those months when crash headlines hit, largely because of the October crash which took markets back in time by about nine months. I personally never define a crash by percentage decline, but rather by how much the clock gets reset by the move. The Summer Crash of put stocks back in time by about eight months much in the same way the crash did, but with a comparatively smaller percentage loss.

What is the ultimate source of a crash? I believe it largely has to do with prolonged disconnects.

Much of the reasoning behind my "call" in for a Summer Crash was related to glaring strength in health care, utilities, consumer staples and Treasurys into the end of Quantitative Easing 2, as inflation expectations dropped and equities pushed higher. The length of time those defensive areas led was so long that in some ways it had to mean a crash was to come as absolute price resynced to relative movement.

Stock Market Crash of - Facts & Summary - hozenesipew.web.fc2.com

The thing is these disconnects can clearly last for a long time, and make any kind of strategy based on historical triggers — which tend to do well in large samples — appear broken. We built our name in and around the inflation-rotation strategy philosophy. Since the taper tantrum began in Maymany of these risk triggers, with hindsight, simply did not work. Of course, the reality of buy low, sell high is that no one ever does it when things are desynced, even though that may be precisely the time to bet on normalization in a strategy that bases history for its rotations using award-winning research.

And yet, every strategy based on historical cause and effect has periods where it is out of step in the small sample of time, as opposed to the large sample of history. In this small sample of time where the deflation-pulse thesis of mine has held true, it is easy to think that the current environment is the way markets will be in the future. That could not be further from the truth when a significant distortion is underway which can be the set up for a crash. It is this distortion which Quantitative Easing 3 created, and which could converge upon its end.

Put simply, stocks are not supposed to be a deflation or disinflation hedge. Yet, we believe the severe disconnect between stocks and inflation expectations shows something is ridiculously make money wmz. Can this gap persist?

Maybe, but I doubt it given that QE3 is ending, and very clear changes to market behavior recently. This gets resolved in one of two ways — either a significant crash-like move in equities, whereby Treasurys severely outperform, or sudden fear of inflation which breaks bonds. With complacency as high as it is and growth expectations continuously lowered, it seems more likely than not that the distortion above gets resolved with equities on the downside.

That alone means risk triggers would not only have a chance to severely outperform, but also brings back much needed volatility for strategies that rely on tactical asset allocation and historical cause and effect. Narrative always follows price. The narrative has been that the economy is fine and that the Fed won. What will the narrative be if the above distortion gets resolved in the blink of an eye? This writing is for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction, or as an offer to provide advisory or other services by Pension Partners, LLC in any jurisdiction in which such offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction.

The information contained in this writing should why does a stock market crash happen be construed as financial or investment advice on any subject matter. Pension Partners, LLC expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing.

The Fund's investment objectives, risks, charges, expenses and other information are described in the statutory prospectus, which must be read and considered carefully before investing. You may download the statutory or summary prospectus or obtain a hard copy by calling ATACFUND or visiting www. Please read the Prospectuses carefully before you invest. Mutual fund investing involves risk.

Principal loss is possible. Because the Funds invest primarily in ETFs, they may invest a greater percentage of its assets in the securities of a single issuer and therefore is considered non-diversified. If a Fund invests a greater percentage of its assets in the tullow oil share price google finance of a single issuer, its value may decline to a greater degree than if the fund held return on binary options where itm financial a more diversified mutual fund.

The Funds are expected to have a high portfolio turnover ratio which has the potential to result in the realization by the Fund and distribution to shareholders of a greater amount of capital gains. This means that investors will be likely to have a higher tax liability. Because the Funds invest in Underlying ETFs an investor will indirectly bear the principal risks of the Underlying ETFs, including but not limited to, risks associated with investments in ETFs, large and smaller companies, real estate investment trusts, foreign securities, non-diversification, high yield bonds, fixed income investments, derivatives, leverage, short sales and commodities.

The Fund will bear its share of the fees and expenses of the underlying funds. Shareholders will pay higher expenses than would be the case if making direct investments in the underlying funds.

Fund holdings are subject to change and are not recommendations to buy or sell any security. References to other securities should not to be interpreted as an offer of these securities. ATAC Inflation Rotation Fund is distributed by Quasar Distributors, LLC.

No other products mentioned are distributed by Quasar Distributors, LLC. By using this site you agree to the Terms of ServicePrivacy Policyand Cookie Policy.

Intraday Data provided by SIX Financial Information and subject to terms of use. Historical and current end-of-day data provided by SIX Financial Information. All quotes are in local exchange time.

Real-time last sale data for U. Intraday data delayed at least 15 minutes or per exchange requirements. Updated Uber CEO Travis Kalanick steps down after shareholder revolt. Crude oil losses accelerate, prices slide 0. European stocks fall, with energy shares lower after oil prices hit 9-month low. Whitbread shares climb 4. France's CAC 40 down 1.

Centrica shares rise 3. Germany's DAX opens 0.

Why stock-market crashes happen - MarketWatch

France's CAC 40 opens 0. Stoxx Europe opens 0. Updated Uber adds tipping to its app as it tries to make broader changes to its culture.

The Stock Market Crash of 1929 - Causes and EffectsUpdated Uber has lost its inevitability, and that may hurt the company most of all. Updated Lyft has been quietly catching up to Uber. Whitbread quarterly same-store sales rise. Centrica sells 2 power stations in U.

Home News Viewer Video SectorWatch Podcasts First Take Games Portfolio My MarketWatch. Retirement Retire Here, Not There Encore Taxes How-to Guides Social Security Estate Planning Events Columns Robert Powell's Retirement Portfolio Andrea Coombes's Working Retirement Tools Retirement Planner How long will my money last?

Economy Federal Reserve Capitol Report Economic Report Columns Darrell Delamaide Rex Nutting Tools Economic Calendar. My MarketWatch Watchlist Alerts Games Log In. Home Trading Deck ETFs. Why stock-market crashes happen. We Want to Hear from You Join the conversation Comment. MarketWatch Site Index Topics Help Feedback Newsroom Roster Media Archive Premium Products Mobile. Dow Jones Network WSJ. ATAC Inflation Rotation;Investor U.