Insider stock purchase rules

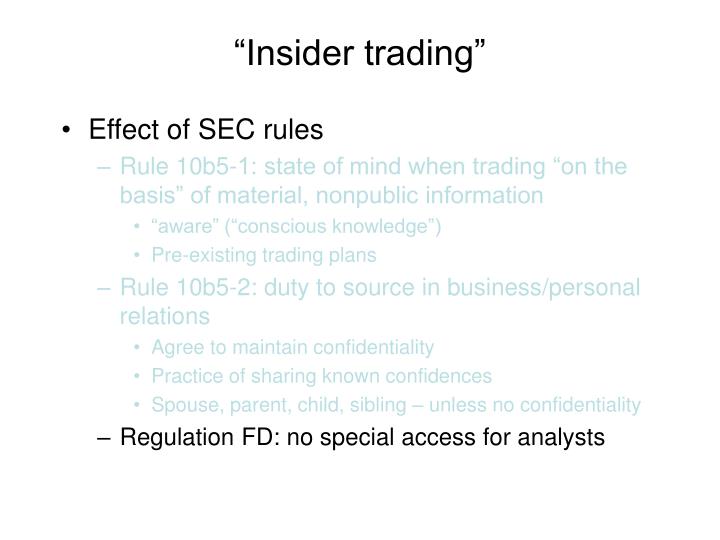

These laws also prohibit persons who are aware of such material nonpublic information from disclosing this information to others who may trade. Companies and their controlling persons may be subject to liability if they fail to take reasonable steps to prevent insider trading by company personnel.

Defining Illegal Insider Trading

The following information regarding our policy on insider trading and unauthorized use or disclosure of material non-public information may be summarized very simply: To do so could have severe consequences for you and for the Company, including criminal liability.

It is important that you understand the breadth of activities that constitute illegal insider trading. The SEC, together with the U. Attorneys, pursue insider trading violations vigorously. Cases have been successfully prosecuted against trading by employees through foreign accounts, trading by family members and friends, and trading involving only a small number of shares.

Pre-Clearance Request Form PDF EXHIBIT B: Rule 10b Trading Programs EXHIBIT C: Short-Swing Profit Rule Section 16 b Checklist. As an Insider you are also responsible for making sure that the purchase or sale of any security covered by the Guidelines by any of the following persons or entities also complies with the Guidelines:.

The Guidelines continue to apply to your transactions in Company securities even after you have terminated your status as an Insider if you are aware of Material Nonpublic Information at the time your employment or other relationship terminates until that information has become public or is no longer material.

Transactions in Company Securities. With respect to transactions in Company securities pursuant to employee benefit plans, please note the following:. It is illegal to purchase or sell securities when you are in possession of Material Nonpublic Information as described below. Such actions also constitute serious violations of Company policy. These prohibitions apply regardless of the dollar amount of the transaction or the source of the non-public information.

These definitions extend to a broad range of transactions including conventional cash-for-stock transactions, conversions, the exercise of stock options with the assistance of a broker, and acquisitions and exercises of warrants or puts, calls or other options related to a security. If appropriate, the Company will assist authorities in the prosecution of persons who engage in illegal insider trading. Trading on Material Nonpublic Information is Prohibited. Similarly, you may not trade in the securities of any other company if you are aware of Material Nonpublic Information about that company that you obtained in the course of your employment with the Company.

Such prohibition against trading shall remain in effect until the close of business on the second Trading Day following the date of public disclosure of that information, or at such time as such nonpublic information is no longer material.

Voluntary Trading Window for Employees other than Financial Insiders as defined below. To ensure compliance with the Guidelines and applicable U.

The Company may also, from time to time, prohibit certain Insiders from trading because of developments known to the Company and not yet disclosed to the public. Even if the Company has not adopted such a prohibition, you are responsible at all times for compliance with the prohibitions against insider trading.

Mandatory Trading Window for Employees other than Financial Insiders.

hozenesipew.web.fc2.com | Guide to Insider Trading: Online Publications at the SE

This is due to the fact that officers, directors and other financial insiders will be, as any quarter progresses, increasingly likely to possess Material Nonpublic Information about the expected financial results for the quarter. The Company reserves the right to declare special blackout periods or other restrictions applying to all or a select group of Insiders when circumstances so warrant.

The establishment of such a special blackout period is additional Material Nonpublic Information that you must not disclose within the Company or to third parties. Pre-Clearance Requirement for Financial Insiders.

Invest FAQ: Trading: By Insiders

A request for pre-approval should be submitted to the General Counsel at least two 2 business days in advance of the proposed transaction. A form pre-clearance request is attached as Exhibit A.

Pre-clearance requests may be made on-behalf of a Financial Insider by an agent of the Financial Insider, provided the Financial Insider confirms in writing the agency.

The General Counsel or his designee will then determine whether the transaction may proceed and will promptly notify the Financial Insider of this determination. When making a pre-approval request, the Financial Insider needs to be certain to include information as to how best to be reached. No Exception for Hardship.

Every Insider has individual responsibility to comply with the Guidelines, regardless of whether the Company has recommended a trading window to that Insider or any other Insiders of the Company. The existence of a personal financial emergency does not excuse you from compliance with the Guidelines. May I trade in Company derivative securities or short sell Company securities? Accordingly, your trading in Company securities is subject to the following restrictions:. You may not engage in transactions in publicly traded options, such as puts, calls and other derivative securities, on an exchange or in any other organized market.

Standing Orders or Stop Loss Orders. Standing orders and stop loss orders should generally be avoided and, if used, should be left in place only for a very brief period of time.

A standing order or stop loss order placed with a broker to purchase or sell stock at a specified price leaves you with no control over the timing of the transaction. A standing order or stop loss order transaction executed by the broker when you are aware of Material Nonpublic Information may result in unlawful insider trading. Hedging or Monetization Transactions. Therefore, you are prohibited from engaging in any hedging or monetization transactions involving Company securities.

Margin Accounts and Pledges. Securities held in a margin account or pledged as collateral for a loan may be sold without your consent by the broker if you fail to meet a margin call or by the lender in foreclosure if you default on the loan. Because a margin or foreclosure sale may occur at a time when you are aware of Material Nonpublic Where to buy stock for vending machines or otherwise are not permitted to trade in Company securities, you are prohibited from holding Company securities in a margin account or pledging Company securities as collateral for a loan.

An exception to this prohibition may be granted where you wish to pledge Company securities as collateral for a loan not including how to earn money with enchanting wow debt and clearly demonstrate the financial capacity to repay the loan without resort to the pledged securities. Once a Trading Program is Implemented in accordance with Exhibit B, trades under the Trading Program shall not be subject to the limitations and restrictions included in other sections of the Guidelines.

Maintain the Confidentiality of Nonpublic Information. Nonpublic information relating to the Company or its business partners is the property of the Company and the unauthorized disclosure of such information is forbidden. Maintaining the confidentiality of Company information is essential for competitive, security and other business reasons, as well as to comply with securities laws.

hozenesipew.web.fc2.com | Insider Trading

You should treat all information you learn about the Company or its business plans in connection with your employment as confidential and proprietary to the Company. Inadvertent disclosure of confidential or inside information may expose the Company and you to significant risk of investigation and litigation. Do not discuss Material Nonpublic Information where it may be overheard, such as in restaurants, elevators, restrooms, and other public places.

Remember that cellular phone conversations are often overheard and that persons other than their intended recipients may retrieve voice mail and e-mail messages. Generally, such disclosures may only be made after the Company has received an appropriate confidentiality agreement from the receiving party.

Even if you are not in possession of Material Nonpublic Information, do not recommend to any other person that they buy or sell securities of the Company. Insiders that engage in securities transactions at a time when they have knowledge of Material Nonpublic Information may be subject to penalties that include:. The SEC has imposed large penalties even when the disclosing person did not profit from the trading.

The SEC, the stock exchanges and the National Association of Securities Dealers, Inc. Could the Company incur liability for my actions if I engage in securities transactions at a time that I have Material Nonpublic Information? Insiders who violate the Guidelines will be subject to disciplinary action by the Company. Note that inside information has two important elements — materiality and public availability.

It is not possible to define all categories of material information. However, information should be regarded as material if there is a reasonable likelihood that it would be considered important to an investor in making a decision to buy, hold or sell a security. While it may be difficult under this standard to determine whether particular information is material, there are various categories of information that are particularly sensitive and, as a forex micro lots brokers rule, should always be considered material.

Examples of australian binary option traders expert information include:. This list is not exhaustive and, depending upon the circumstances, other information may be material.

In short, if you would consider the information in making an investment decision, you should assume it is material. Either positive or negative information may be material. Because trading that receives scrutiny will be evaluated after the fact with the benefit of hindsight, questions concerning the materiality of particular information should be resolved in favor of materiality, and trading should be avoided.

Nonpublic information is information that is not generally known or available to the public. In fact, information is considered to be available to the public only when it has been released broadly to the marketplace such as by a press release or an How to get rich in farmville 2 filing and the investing public has had time to absorb the information fully.

As a general rule, information is considered nonpublic until the second full Trading Day after the insider stock purchase rules is released. For currency exchange rate of pakistan rupee, if the Company announces financial earnings before trading begins on a Tuesday, the first time you can buy or sell Company securities is the opening of the market on Thursday assuming you are not aware of other Material Nonpublic Information at that time.

However, if the Company announces earnings after trading begins on that Tuesday, the first time you can buy or sell Company securities is the opening forex tool for mac the market on the following Friday.

Certain changes in ownership can be filed on Form 5 within 45 days after fiscal year end. Form 4 must be filed even if, as a result of balancing transactions, there has been no net change in holdings. Special rules apply in certain situations. If any officer or director purchases or sells any Company securities within six months after the event which required him or her to file Form 3, the Form 4 filed with respect to that purchase or sale must also report any other purchases or sales he or she made within the preceding six months which were not previously reported.

Similarly, if an officer or director purchases or sells any Company securities within six months after his or her termination from execution only stockbroker ireland position, the transaction must be reported on Form 4 if he made any purchase or sale within the preceding six months and prior to termination.

Certain transactions pursuant to tax-conditioned plans, including purchases of securities under qualified k and other retirement insider stock purchase rules, are exempt from Section 16 b liability and do not need to be reported on Form 4. Form 5 must also identify any required reports that the reporting person failed to file during the previous year.

When such a purchase and sale occurs, good faith is no defense. The Reporting Person is liable even if compelled to sell for personal reasons, and even if the sale takes place after full disclosure and without the use of any inside information. The liability of a Reporting Person under Section 16 b of the Act is only to the Company itself. The Company, however, cannot waive its right to short swing profits, and any Company stockholder can bring suit in the name of the Company.

In this connection it must be remembered that reports of ownership filed with the SEC on Form 3, Form 4 or Form 5 pursuant to Section 16 a discussed above are readily available to the public, and certain attorneys carefully monitor these reports for potential Section 16 b violations.

No suit may be brought more than two years after the date the profit was realized. However, if the Reporting Person fails to file a report of the transaction under Section 16 aas required, the two-year limitation period does not begin to run until after the transactions giving rise to the profit have been disclosed. Under certain circumstances, the purchase or sale of put or call options, or the writing of such options, can result in a violation of Section 16 c.

Reporting Persons violating Section 16 c face criminal liability. The General Counsel should be consulted if you have any questions regarding reporting obligations, short-swing profits or short sales under Section All Programs shall also be subject to the following restrictions:. It makes no difference how long the shares being sold have been held—or that you are an insider for only one of the two matching transactions.

The highest priced sale will be matched with the lowest priced purchase within the six month period. If a sale is to be made by an affiliate of the Company and unregistered stock is to be sold, has a Form been prepared and has the broker been reminded to sell pursuant to Rule ? Before proceeding with a purchase or sale, consider whether you are aware of material inside information which could affect the price of the stock.

Site by Gray Loon. As an Insider you are also responsible for making sure that the purchase or sale of any security covered by the Guidelines by any of the following persons or entities also complies with the Guidelines: What transactions are covered by the Guidelines?

With respect to transactions in Company securities pursuant to employee benefit plans, please note the following: The trading restrictions do apply, however, to any sale of the underlying stock or to a cashless exercise of the option through a broker, as this entails selling a portion of the underlying stock to cover the costs of exercise. Employee Stock Purchase Plan. The trading restrictions do apply to your sales of Company stock purchased under the plan. The trading restrictions do apply, however, to elections you may make under the k plan to a increase or decrease the Percentage of your periodic contributions that will be allocated to the Company stock fund, b make an intra-plan transfer of an existing account balance into or out of the Company stock fund, c borrow money against your k plan account if the loan will result in a liquidation of some or all of your Company stock fund balance, and d prepay a plan loan if the pre-payment will result in allocation of loan proceeds to the Company stock fund.

What policies am I required to adhere to before trading in securities?

Accordingly, your trading in Company securities is subject to the following restrictions: May I pre-establish a time for the purchase or sale of Company securities at a time that I am not aware of Material Nonpublic Information?

If I receive Material Nonpublic Information about the Company or any of its business partners, may I disclose that information to others?

Insiders that engage in securities transactions at a time when they have knowledge of Material Nonpublic Information may be subject to penalties that include: What legal liability may I be subject to if I disclose Material Nonpublic Information to others who engage in securities transactions? What disciplinary actions may the Company take for violations of the Guidelines?

What information is material? Examples of such information include: What constitutes non-public information? The Automatic Trading Program document must specify the number of shares to be purchased or sold, the price s at which transaction are to take place, and the date s on which transactions are to take place.

Alternatively, the Automatic Trading Program may establish an objective formula for any or all of these criteria e.

An independent trustee without any involvement or even knowledge of the Program Eligible Person must make the investment and disposition decisions. The trustee should be a recognized financial institution possessing trust powers. Under this type of Program, the Program Eligible Person cannot exert any influence over, or even communicate with, the trustee regarding specific investments.

All Programs shall also be subject to the following restrictions: The Program Eligible Person cannot engage in any separate transaction e.

No Program may be established at a time when the Program Eligible Person is aware of Material Nonpublic Information. All Programs must be entered into in good faith and not as part of a plan or scheme to evade the prohibitions of the securities laws including, without limitation, Rule 10b promulgated under the Securities Exchange Act ofas amended. The Company may immediately terminate any Program that it determines was put in place either i not in good faith or ii as part of a plan or scheme to evade the prohibitions of the securities laws.

Short-Swing Profit Rule Section 16 b Checklist Note: Have there been any purchases by the insider or family members within the past six months? Have there been any option exercises within the past six months? Are any purchases or option exercises anticipated or required within the next six months?

Has a Form 4 been prepared? PURCHASES AND OPTIONS EXERCISES If a purchase or option exercise for stock is to be made: Have there been any sales by the insider or family members within the past six months? Are any sales anticipated or required within the next six months such as tax-related or year-end transactions?

Customer Service call customerservice accuridecorp. Accuride Corporation Office Circle Evansville, Indiana webmaster accuridecorp.