Stock option expiration accounting

All other stock option plans are assumed to be a form of compensation, which requires recognition of an expense under U.

Expensing Stock Options: A Fair-Value Approach

The amount of the expense is the fair value of the options, but that value is not apparent from the exercise price and the market price alone. Option valuation is a finance concept, and it generally relies on the Black-Scholes method, which is beyond the scope of this article. The expense is recorded equally throughout the entire vesting period , which is the time between the date the company grants the options and when the individual is allowed to exercise the option.

In other words, U.

CIEL Design for Gardens | Austin Texas Landscape Architecture and Garden Art Design Company |

The entry credit is to a special additional paid-in capital account. Friends Company, a fictitious entity, grants its CEO 5, stock options on January 1, 20X4.

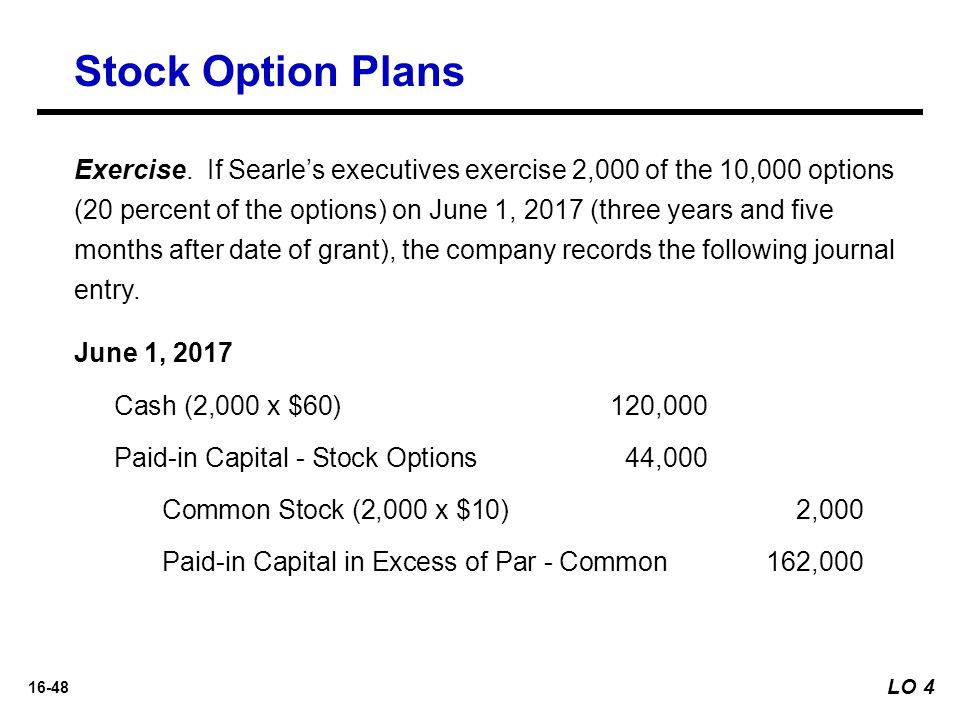

Each year, the company will record the following compensation entry. If the options are exercised, the additional paid-in capital built up during the vesting period is reversed.

If the options are not used before the expiration date, the balance in additional paid-in capital is shifted to a separate APIC account to differentiate it from stock options that are still outstanding.

Understanding the New Accounting Rules For Stock Options and Other Awards - FindLaw

Sign In Pricing FAQ. Accounting Tutorials Accounting Articles Accounting Tests Accounting Dictionary My Studyboard.

Stock option expensing - Wikipedia

Basics of accounting for stock options. Compensatory stock option plans. Options not considered compensation 3.

Download free accounting study notes by signing up for our free newsletter example:. Ask a Question Suggest a Topic. Do you have an interesting question or topic?

Suggest it to be answered on Simplestudies. Browser does not support frames!