Interactive brokers forex hedge

The Better Way to Invest. Welcome to the Share Wealth Systems forum. Home Help Search Calendar Login Register. Hi All, I have an account with Interactive Brokers as that is the only platform eSuper allows for trading in the USA. Having only started it mid last year, I did not get the benefit of having much of a buffer on my portfolio value due to entering at a lower exchange rate.

Besides, the outlook at the time was that the AUD would continue to weaken. How quickly things have changed.

Saxo has a spread of 0.

Needless to say, I did not act on the hedge signal given on the 1st Feb this year fearing I would get the same result. There was a post on the forum last year about currency risk where a member said hedging or trading forex is not allowed through Interactive Brokers.

I know that IB does not have much of a spread, if anything at all when converting from AUD to USD, and that the fee would probably be a few dollars, so I would prefer to hedge through them if possible.

I just called IB and they said I can go long the AUD using futures. I don't know anything about futures, so I wanted to ask if anyone else is doing it through IB before I go through the process of learning how it works, only to find it's not allowed or is not possible.

Alternatively, if anyone is hedging their portfolio using any other instrument through IB, I would appreciate knowing what it is so I can look into it as well.

Nick Rossetto Full Member Posts: I was led to believe from IB that no FX trades were available to Australian clients I still have an open short position on AUD from 87 last year when I moved into USD to trade the ETFs - needless to say it is less profitable than it was..

I really don't want another broker to deal with though. Hi Phil Yes, it is esuperfund that I am with. Apologies Nick for the confusion. I see there is another fund provided by AMP called esuper which I was not aware of. The other reason I prefer IB to Saxo for my USA portfolio is that once your funds are converted from AUD to USD, they remain in USD.

With Saxo, each of my ETF transactions were converted from AUD to USD when entered, and from USD back to AUD on exit. I have a long term outlook with my portfolio and would prefer to keep it in USD until the time comes when I want it back in AUD, at which point it can be converted back. With CMC Markets, I think they have even worse spreads than SAXO, charge data fees as long as you have open positions, and you can't do stocks and CFD's out of the same account.

I am not sure about Ebroking, but Commsec also has very high transaction costs per trade.

I really think that IB is the best way to trade SPA3 for those on eSuperfund. It would be great though to hear from others who have experience hedging through them.

Looking for ways to hedge my EUR salary against drops in EUR/USD : investing

Hi Phil, I also trading through IB and have be interested in doing this as well. Can anyone from SWS confirm whether this is being developed?

In terms of how the hedge process works and how SWS place their one in Saxo, here are the details I got from them previously: We still use a CFD for the Futures contract to the currency to place the hedge.

It should take you to the 1 hour 6 minute mark.

25+ best ideas about Interactive Brokers on Pinterest | Stock market for beginners, Learn stock market and Investment tips

IB do have a Futures instrument for AUDUSD but I am not sure if it is the same as the one in Saxo and don't know enough about Futures to understand what if any the difference is. Can anyone from SWS assist with how to place this hedge in IB?

Hi, Wondering whether anyone from SWS has read this post and is able to post a response? Hi all, We cannot really help with the IB discussion as we are not experts in the area of their platform and offerings.

For discussing the instruments they have available to trade for Forex we would suggest contacting them directly for a discussion. Hedge trades will be able to be tracked in the future with the new portfolio manager product that is being developed but this will come out in a longer time frame.

Kind Regards, Campbell Sinclair. Hi All With the AUD starting to strengthen again, I have looked further into how I can hedge my portfolio through IB and am happy to share my findings and limited understanding so far.

Margin Requirements - Canada | Interactive Brokers

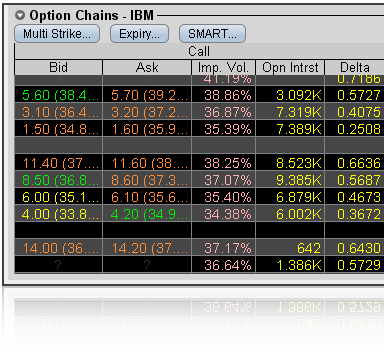

Firstly, I opened a paper trading account through IB which was very easy to do. If you click on paper trading, you can easily set up your paper trading account. A window pops up giving the selection of various contracts for AUD GLOBEX, namely: The actual AUDUSD exchange rate when the window popped down was 0. You then need to choose how many positions you want. Once the contract has been entered into, say at 0.

If the AUDUSD rate were to move to 0. This I understand to be a hold on my funds to that amount to cover IB should this transaction turn into a loss, they have the funds secured. This will fluctuate, ie, become more if the AUD weakens and become less if it strengthens. I hope my understanding of this instrument and the way it works is correct.

If anyone sees any inaccuracies in the above, please let me know. Johnathan Habersberger Newbie Posts: Hi Tito, I have been trading futures for the past decade so will try to help here. Your understanding is correct. Note that the contract has a delivery date, which means for non-physical futures such as currency rates you will be exited automatically as I am almost certain IB won't let you be delivered on, but I would check to make sure that all contracts are exited before delivery.

Many brokers will not trading as against hedging customers take delivery. In this fashion it is like an option. Losses will be automatically deducted from your account on an exit so make sure you have enough free cash if your margin won't cover it, they might let you do this if there is sufficient assets in the stock sector. IB are quite flexible like this which is nice. In this situation you identified I would take the Dec contract, less work for similar price.

The Jun contract expires in a few weeks. Otherwise you are spot on. Indeed that is quite a favourable structure usually back months are more expensive due to carrying costs.

I hope this has been helpful, let me know if anything else needs clarifying, Cheers, Jonathon. Hi Johnathan Thank you very much for your reply and information provided. I also asked about the difference between the AUD June contract and the AUD June Continuous contract. They have the same expiry date with the only difference being there is much more historical data available for the continuous contract as opposed to the June contract, so you are correct in saying it best to go for the Dec contract rather than the June contract which is about to expire.

Looking at the chart on TWS for the AUD Dec contract, the volumes look very thin by comparison to the June contract. I would imagine as you get closer to the expiry date, the volumes will start to increase. The only concern being for example, if I were to enter the Dec contract now and want to exit it say in July still a long way from Dec , would it be easy to sell ie, get a buyer considering the lower volumes?

Looking at the AUDUSD chart on Beyond Charts, it looks about to give an entry hedge signal. A concern which possibly Gary could answer is whether it would be wise to hedge now considering the Brexit referendum. From what I gather this is an event which could have an impact on the AUDUSD exchange rate. If we do get a hedge signal, do we follow the signal or should we wait until after the 23rd June? OK Tito, we are getting there. The continuous contract refers to charting which knits together each expiry month for historical data.

I won't go into the details but this is a very contentious area for system designers. It will automatically roll the chart, but you don't trade per se off the continuous contract. On the IMM distant months volumes can get a bit thin the difference between hedgers and speculators but at your indicative volumes you will always get a fair fill, particularly at low interest rates this will always be arbitraged by someones algorithm.

It is therefore easiest to trade the more distant contract. I would just buy 1 Dec Au contract and you are done for the rest of the year. I would not worry about Brexit or anything else. In this setting we are system traders, not event driven macro funds.

We, or certainly I, can't analyse and take a position in these events. It is a highly specialised and profitable field, George Soros and Stan Druckenmiller were the masters at this type of thing and they do not advertise which side of trades they are on!

I am pretty sure Gary would advise put the hedge on now, roll it in December and go from there.

Hope this helps, good luck. Hi Johnathan Thanks for your timely reply! I see the signal has been given to hedge the AUD vs the USD. I have done the trade and am long at 0. Thank you very much for your assistance and input.

Gary Stone Administrator Posts: Research of historical data has all sorts of events built into it. Sure different and even unique events. Brexit right now is a known upcoming event.

What is unknown is which way it will go. But there are also other major and not so major variables that also impact the AUDUSD and every other market pricing.

Which way the AUDUSD continues to move will be the net aggregate of the weighted effect of each and every one of those variables, in any given timeframe. Trying to predict the weighting of a single variable and its effect against the aggregate of all other variables is a tough, some might say impossible, gig unless you have some insider info. Not knowing, and hence being uncertain, is risk. That's price action in financial markets summed up. Hi Johnathan Many thanks for your input on this thread.

I am able to use the Futures feature GLOBEX through my Interactive Brokers Cash Account in the name of our SMSF as well. My scenario is last year I SOLD AUD, at 87 to get some USD to trade the US listed ETFs and ETF Stocks.

Gary mentioned not using the spot because of funding costs and to use SAXO CFDs. This would mean having an additional broker. Are you able to explain the difference? Have I got this right? Hi Nick, I will endeavour to help as best I can here again.

The carry in futures contracts is built into the price structure, ie the spread between short dated and long dated months. The far contracts are usually more expensive than near ones due to the cost of carry. Occasionally this price structure changes and can be a useful trading signal if one knows how to exploit it, but I digress.

Therefore much safer in my opinion, Hope this helps, Cheers, Jonathon.