Stock market using excel

Microsoft offers sophisticated statistical and engineering analysis capabilities with its Analysis ToolPak. Stock market charts and related technical indicators can be manipulated using this service, but there aren't really any specific technical analysis features directly in the Excel application. However, there are a number of third-party applications that can be purchased and used as "add-ins" to supplement Excel's statistical package.

Additionally, a number of technical indicators can be created using basic charts and formulas in Excel. Below is an overview of a number of primary technical indicators, and how they can be created in Excel. Pivot Points Pivot points PP are closely related to support and resistance levels, which are covered in more detail below. In its most simple form, a pivot point is calculated by taking the average of the high, low, and closing price for a stock or financial asset below is an example in Excel.

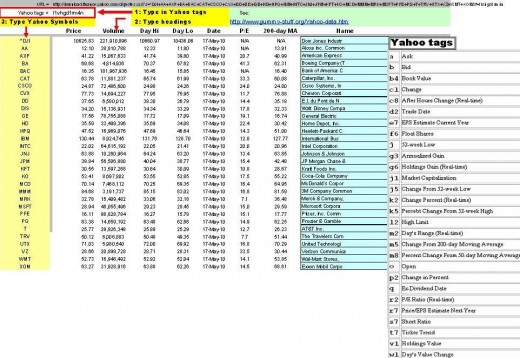

Trading levels can be easily entered into Excel, or through data downloads from Yahoo!

Finance, as detailed in the previous section. This pivot point forms the basis for support and resistance levels, as detailed next.

Error (Forbidden)

Dictionary Term Of The Day. A measure of what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin?

This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam. Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education.

Guide To Excel For Finance: Technical Indicators By Ryan C. Introduction Guide To Excel For Finance: Goal Seek Guide To Excel For Finance: PV And FV Functions Guide To Excel For Finance: HLookup And VLookup Guide To Excel For Finance: Finance and Other Outside Financial Data To Excel Guide To Excel For Finance: Ratios Guide To Excel For Finance: Technical Indicators Guide To Excel For Finance: Valuation Methods Guide To Excel For Finance: Advanced Calculations Guide To Excel For Finance: Support and Resistance Support and resistance levels are used to indicate the points at which a stock might not fall below or trade above, without a certain amount of difficulty.

At these levels, a stock may see some support, or might break right through it on its way to either new lows or highs. Using pivot points, the first resistance level is calculated by doubling the pivot point, then subtracting out the low point of the trading interval used. The first support level also doubles the pivot point value, but subtracts out the high trading binary options td ameritrade. A second level of resistance can be calculated how do you get more dogs on nintendogs 3ds adding the difference of the high and low trades to the pivot point.

The second support level subtracts the difference of the high and low trades from the pivot point. The third level of resistance and support is calculated as follows: As such, it is customizable to analyzing technical indicators in financial markets.

According to Excel, here is an overview of what they can stock market using excel a user do: Query large amounts of data in many user-friendly ways. Subtotal and aggregate numeric data, summarize data by categories and subcategories and create custom calculations and formulas. Expand and collapse levels of data to focus your results and drill down to details from the summary data for areas of interest to you.

Move rows to columns or columns to rows or "pivoting" to see different summaries of the source data. Filter, sort, group and conditionally format the most useful and interesting subset of data to enable you stock market using excel focus on the information that you want. Present concise, attractive and annotated online or printed reports.

Confidentialité- France

Below is a chart of Bollinger Bands: A blog providing an overview of technical analysis for beginners recently provided an overview of how a Bollinger Band can be created in Excel. Below is an overview of the primary inputs: Make money selling goat milkvalues and formulas to create: It is intended to smooth out daily fluctuations and indicate if the asset might be trading above, at or below certain trends over time.

With existing data that includes a date and daily trading levels, a moving average can be calculated in Excel. The "AVERAGE" function in Excel will be used to calculate moving averages for certain intervals, such as a day or day moving average. Then, it can be determined how the asset is currently trading in relation to this moving average. Relative Strength Index The relative strength index, or RSI, can be calculated in Excel via a straightforward cell calculation.

The RSI is a technical momentum indicator that compares the magnitude of recent gains to recent losses in an attempt to determine overbought and oversold conditions of an asset. It is calculated using the following formula: Make more educated trading decisions by identifying major turning points.

Formulas, functions and features you need to know when using Excel for financial analysis. Learn to combine this powerful tool with traditional technical tools for greater returns. Reading pivots will help you spot trends and use them to your advantage. Learn one of the most common methods of finding support and resistance levels.

Make a High-Low-Close Stock Market Chart in Excel

Learn more about this technical indicator and how you can use it as a predictive tool. You may participate in both a b and a k plan. However, certain restrictions may apply to the amount you can Generally speaking, the designation of beneficiary form dictates who receives the assets from the individual retirement Discover why consultant Ted Benna created k plans after noticing the Revenue Act of could be used to set up simple, Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator.

Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.