Should i buy american airlines stock

Warren Buffett recently bought stock in the four major airlines after avoiding the industry for years.

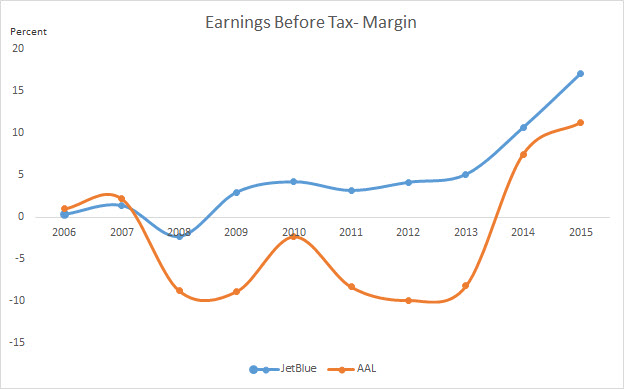

Warren Buffett has warned investors about putting money in airline stocks several times. He even had his own ill-fated investment in US Air in although he eventually turned a profit on it. However, after decades of disparaging the investment merits of the airline industry, this past February he has pulled a and bought significant sums of stock of the four major airlines Delta NYSE: DAL , United NYSE: UAL , Southwest NYSE: LUV , and American Airlines NASDAQ: So should investors follow Buffett's lead and buy some airline stocks?

To answer the question, we need to look at how the airline industry has evolved over the past few decades and what the current business environment looks like. The airline industry was deregulated in Out of the original carriers only about 68 are left.

10 Best Airline Stocks for - Top Stocks - TheStreet Ratings

The great recession in forced more consolidation in the industry. Under the Obama administration the industry went from 7 major airlines to just four. Today the domestic airline market share looks like this source.

We know airlines are profitable now but will that continue? Does the current market structure lend itself to steady profits or will the brutal competition of yesteryear return? By some definitions, the current airline industry is an oligopoly.

It's also hard for new major competitors to enter the domestic market.

It would take billions to lease a fleet of aircraft and build out the infrastructure necessary to compete on the major profitable routes. Instead, competition is mainly limited to smaller regional routes where profits are low and new players can more easily enter the market.

On the other hand, the larger markets should still be competitive. The airline industry also doesn't rank very high using the Herfindahl-Hirschman Index HHI which measures market concentration. We calculated a HHI number of. Our calculation of the HHI number for the industry is below. We used the market share numbers from earlier in the article and then assumed that the remaining As you can see the exact market share of the remaining 79 is mostly irrelevant to the calculation as it only changes the ten-thousandths digit of the HHI number.

So the actual market share of the rest of the carriers is mostly irrelevant and just assuming an equal weight will not affect the calculation. Therefore, by most measures the airline industry right now is in sort of a limbo.

It's not an attractive oligopoly like say the credit card market Visa, MasterCard and a distant American Express and Discover and it's not the brutally competitive, money losing, bottomless pit for investor capital that it was in the s and s.

There is an additional reason for investors in the airline industry to be optimistic. There are studies that have shown that when companies in a particular industry share common ownership it tends to improve industry profit margins. The largest airline companies share quite a few common investors as this chart from HBR shows.

Common ownership means that there is intense outside pressure for companies to focus on increasing profits by becoming more efficient versus increasing sales and market share through competition with rivals. After all, why would Warren Buffett want to encourage Delta Air Lines to get in a price war to increase market share when that increase in market share is likely to come from United, Southwest, and American Airlines, which he already owns?

He would just be moving money from one pocket to another in the best scenario in all likelihood the amount of profit would drop as more competition would drop margins.

AAL - American Airlines Stock quote - hozenesipew.web.fc2.com

In summary, it's easy to see why Buffett has changed his mind with the airline industry. The industry has undergone a drastic change. Not only has the number of major airlines consolidated from 10 to four but ownership of those airlines has become more concentrated as well. However, we still do not think blindly following Buffett and buying airlines is a great idea.

It is still a highly competitive business where many customers shop on price alone or at least put an emphasis on price. The business is still cyclical with high fixed costs and is still very capital intensive.

AA Stock on 911 835AM American Airline Stock Drop Real Time BEFORE the hitIf you want to follow a well-known investor into a cyclical, capital intensive business, we'd pick following David Einhorn in GM before we looked at the airline industry for ideas. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it other than from Seeking Alpha. I have no business relationship with any company whose stock is mentioned in this article. Portfolio Strategy Fixed Income Bonds Financial Advisors Retirement Editor's Picks.

Should You Follow Buffett's Lead And Buy Airline Stocks?

AAL Stock Price - American Airlines Group Inc. Stock Quote (U.S.: Nasdaq) - MarketWatch

Summary Warren Buffett recently bought stock in the four major airlines after avoiding the industry for years. The industry has consolidated significantly since being deregulated. Despite consolidation the industry still appears competitive to a certain degree. The Airline Industry Then and Now The airline industry was deregulated in Oligopoly or Competitive Market? Summary In summary, it's easy to see why Buffett has changed his mind with the airline industry.

Want to share your opinion on this article? Disagree with this article? To report a factual error in this article, click here.

Follow Strubel Investment Management and get email alerts. Invest alongside Strubel Investment Management. Strubel Investment Management employs a careful and rigorous qualitative and quantitative screening and research process, taking into account both macroeconomic and firm specific factors. We favor large and mid-cap companies that are monopolies or operate in oligopolistic industries. We adhere to strict position sizing limits to minimize risk of catastrophic losses.