Backdating stock options

Do you ever wish that you could turn back the hands of time? Some executives have, well, at least when it comes to their stock options. In order to lock in a profit on day one of an options grant, some executives simply backdate set the date to an earlier time than the actual grant date the exercise price of the options to a date when the stock was trading at a lower level.

This can often result in instantaneous profits! In this article, we'll explore what options backdating is and what it means for companies and their investors.

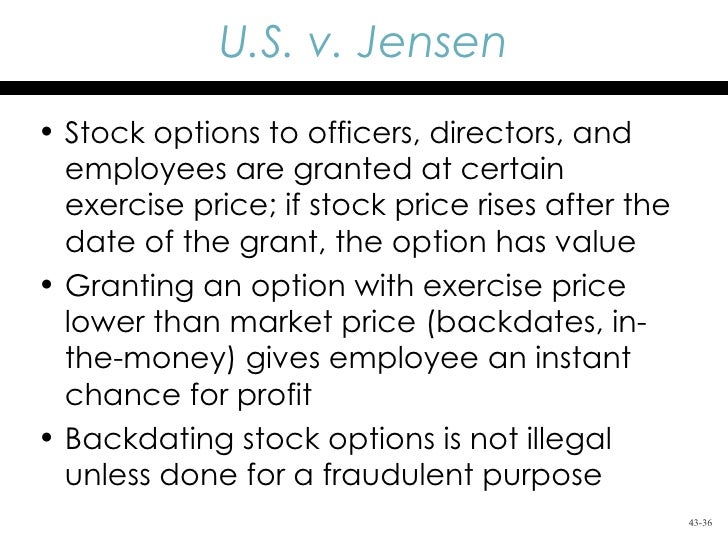

Employee Stock Options Is This Really Legal? Most businesses or executives avoid options backdating; executives who receive stock options as part of their compensation, are given an exercise price that is equivalent to the closing stock price on the date the options grant is issued.

This means they must wait for the stock to appreciate before making any money. For more insight, see Should Employees Be Compensated With Stock Options? Although it may appear shady, public companies can typically issue and price stock option grants as they see fit, but this will all depend on the terms and conditions of their stock option granting program. However, when granting options, the details of the grant must be disclosed, meaning that a company must clearly inform the investment community of the date that the option was granted and the exercise price.

The facts cannot be made unclear or confusing. In addition, the company must also properly account for the expense of the options grant in their financials. If the company sets the prices of the options grant well below the market price, they will instantaneously generate an expense, which counts against income. The backdating concern occurs when the company does not disclose the facts behind the dating of the option.

To learn more, read The "True" Cost Of Stock Options , The Controversy Over Option Expensing and A New Approach To Equity Compensation. In short, it is this failure to disclose - rather than the backdating process itself - that is the crux of the options backdating scandal. To be clear, the majority of public companies handle their employee stock options programs in the traditional manner.

That is, they grant their executives stock options with an exercise price or price at which the employee can purchase the common stock at a later date equivalent to the market price at the time of the option grant.

They also fully disclose this compensation to investors, and deduct the cost of issuing the options from their earnings as they are required to do under the Sarbanes-Oxley Act of But, there are also some companies out there that have bent the rules by both hiding the backdating from investors, and also failing to book the grant s as an expense against earnings. On the surface - at least compared to some of the other shenanigans executives have been accused of in the past - the options backdating scandal seems relatively innocuous.

But ultimately, it can prove to be quite costly to shareholders. To learn more, see How The Sarbanes-Oxley Era Affected IPOs. Cost to Shareholders The biggest problem for most public companies will be the bad press they receive after an accusation of backdating is levied, and the resulting drop in investor confidence. While not quantifiable in terms of dollars and cents, in some cases, the damage to the company's reputation could be irreparable.

Another potential ticking time bomb, is that many of the companies that are caught bending the rules will probably be required to restate their historical financials to reflect the costs associated with previous options grants. In some cases, the amounts may be trivial. In others, the costs may be in the tens or even hundreds of millions of dollars.

In a worst-case scenario, bad press and restatements may be the least of a company's worries. In this litigious society, shareholders will almost certainly file a class-action lawsuit against the company for filing false earnings reports.

For more information, see The Pioneers Of Financial Fraud.

The executives of companies involved in backdating scandals may also face a host of other penalties from a range of governmental bodies. Among the agencies that could be knocking on the door are the Justice Department for lying to investors, which is a crime , and the IRS for filing false tax returns.

Clearly, for those who own shares in companies that don't play by the rules, options backdating poses serious risks.

If the company is punished for its actions, its value is likely to drop substantially, putting a major dent in shareholders' portfolios. A Real-Life Example A perfect example of what can happen to companies that don't play by the rules can be found in a review of Brocade Communications. The well-known data storage company allegedly manipulated its stock options grants to ensure profits for its senior executives and then failed to inform investors, or to account for the options expense s properly.

In other words, it had to restate earnings. It has also been the subject of a civil and a criminal complaint. The total cost to shareholders, in this case, has been staggering. How Big Is the Problem? According to a study by Erik Lie at the University of Iowa, more than 2, companies used options backdating in some form to reward their senior executives between and In addition to Brocade, several other high profile companies have become embroiled in the backdating scandal as well.

While reports of past indiscretions are likely to continue to surface, the good news is that companies will be less likely to mislead investors in the future. This is thanks to Sarbanes-Oxley. Prior to , when the legislation was adopted, an executive didn't have to disclose their stock option grants until the end of the fiscal year in which the transaction or grant took place.

However, since Sarbanes-Oxley, grants must be filed electronically within two business days of an issue or grant. This means that corporations will have less time to backdate their grants or pull any other behind-the-scenes trickery. It also provides investors with timely access to grant pricing information.

June 22, 2011 CLE: Stock-options back-dating to Foreign Corrupt Practices ActBeyond Sarbanes-Oxley, the SEC approved changes to the listing standards of the NYSE and the Nasdaq in that require shareholder approval for compensation plans. It also approved requirements that mandate that companies outline the specifics of their compensation plans to their shareholders.

To read more on this topic, check out The Benefits And Value Of Stock Options. Dictionary Term Of The Day. A measure of what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam.

Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. The Dangers Of Options Backdating By Glenn Curtis Share. Any time money is involved, a scandal is sure to follow. Find out how a university study blew the cover off this one.

The pros and cons of corporate stock options have been debated since the incentive was created. Learn more about stock option basics and the cost of stock options. These plans can be lucrative for employees - if they know how to avoid unnecessary taxes. There has been much debate over whether companies should treat employee stocks options as an expense.

Marvell Technology Group - Wikipedia

This article examines both sides of the argument. In , Senators Carl Levin and John McCain introduced a bill to stop the excessive deductions for ESOs.

But is there another solution? The ability to exercise only on the expiration date is what sets these options apart. Learn more about stock options, including some basic terminology and the source of profits.

Economist's View: Why Backdate Stock Options?

The new financial accounting standard known as FAS R could take a bite out of your portfolio. Find out why here. Options backdating occurs when companies grant options to their executives that correspond to a day where there was a significantly The practice of options backdating has landed many companies into the hotseat.

The SEC constantly investigates possible instances Learn how the SEC and IRS regulate employee stock options, including the exercise of options and the sale of options, and Learn how option selling strategies can be used to collect premium amounts as income, and understand how selling covered Understand how options may be used in both bullish and bearish markets, and learn the basics of options pricing and certain An expense ratio is determined through an annual A hybrid of debt and equity financing that is typically used to finance the expansion of existing companies.

A period of time in which all factors of production and costs are variable. In the long run, firms are able to adjust all A legal agreement created by the courts between two parties who did not have a previous obligation to each other.

A macroeconomic theory to explain the cause-and-effect relationship between rising wages and rising prices, or inflation. A statistical technique used to measure and quantify the level of financial risk within a firm or investment portfolio over No thanks, I prefer not making money.

Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator. Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers.

Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.