Implied volatility and options prices

October 20, by The dough Team.

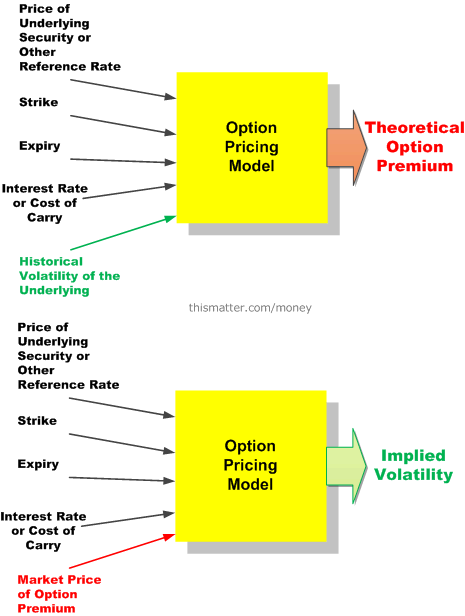

The Implied Volatility of an underlying is simply the size of a one standard deviation move for a given period. In reality, IV Rank is way more helpful than the implied volatility number alone, because you want to understand where IV is now in relation to where it lives normally.

Click for more on IV RANK from tastytrade.

Implied Volatility (IV)

At dough, our assumption is generally that, in time, implied volatility will get back to normal. So when the IV Rank is high, option prices are richer - this is when we like to sell.

And when the IV Rank is low, option prices are cheaper - this is when we might consider buying. Or, because we prefer to sell premium when IV is high, if the IV Rank is low we might scale back a little bit and wait for IV to expand.

With an underlying that has a high IV Rank, you can get a better return on capital, and sell strikes further out of the money, while collecting similar credit. Click for more on TRADING USING IV RANK from tastytrade.

Watch Step Up to Options to learn more about basic options trading. This week she is talking about IV Rank, see what questions the support desk gets the most! See the videos in the post to learn more! We generally receive a fair amount of questions around earnings and how to trade them.

I wanted to share with you what I look at when I trade earnings and show you how I set up an earnings trade using the dough platform. Beginner intermediate Blog Sign Up Login.

Using Implied Volatility to Determine the Expected Range of a Stock | OptionsANIMAL

So how do you know if IV is actually high or low? We check the IV Rank. The Three Keys to understanding Implied Volatility and IV Rank: To learn more, sign up for dough Jul 2, beginner iv rank , implied volatility , high implied volatility , education , Tracy Algeo Tracy Algeo Comment.

Apr 10, beginner Ryan Grace , michael "beef" hart , program , webinar , implied volatility , iv rank Brian Mallia Comment. Apr 9, beginner Trading strategy , earnings , iv rank Mike Butler Comment. The 5 Factors I Look At When Trading Earnings.