Iron butterfly spread example

Traditional Roth IRA Conversion RMD Beneficiary RMD How to Invest Overview Investing Basics Overview Set Your Goals Plan Your Mix Start Investing Stay on Track Find an Account that Fits Waiting Can Be Costly Saving for Retirement Overview How to Save for Retirement Retirement Savings Strategies: What's new Where are my tax forms?

You can do this in two ways:. You may send this page to up to three email addresses at a time. Multiple addresses need to be separated by commas.

Butterfly Spread Explained | Online Option Trading Guide

The body of your email will read: Sharing this page will not disclose any personal information, other than the names and email addresses you submit. Schwab provides this service as a convenience for you.

By using this service, you agree to 1 use your real name and email address and 2 request that Schwab send the email only to people that you know. It is a violation of law in some jurisdictions to falsely identify yourself in an email. You also agree that you alone are responsible as the sender of the email. Schwab will not store or use the information you provide above for any purpose except in sending the email on your behalf.

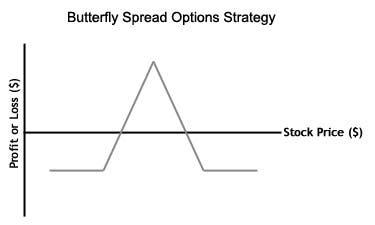

A short iron butterfly spread is a neutral strategy you might want to consider when you expect a stock or ETF to remain in a narrow trading range. Randy Frederick, Schwab Managing Director of Trading and Derivatives. Options carry a high level of risk and are not suitable for all investors.

Certain requirements must be met to trade options through Schwab. Multiple-leg options strategies will involve multiple commissions. For the sake of simplicity, the examples in this presentation do not take into consideration commissions and other transaction fees, tax considerations, or margin requirements, which are factors that may significantly affect the economic consequences of strategies displayed.

Please contact a tax advisor for the tax implications involved in these strategies. Spread trading must be done in a margin account. Supporting documentation for any claims or statistical information is available upon request. Schwab's StreetSmart Edge and StreetSmart. Call to request access a Schwab brokerage account is required.

Schwab reserves the right to restrict or modify access at any time. The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions.

Data contained herein from third-party providers are obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Long Calendar Put Spread | Calendar Spreads - The Options Playbook

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve. The Charles Schwab Corporation provides a full range of brokerage, banking and financial advisory services through its operating subsidiaries. Its banking subsidiary, Charles Schwab Bank member FDIC and an Equal Housing Lender , provides deposit and lending services and products. Access to Electronic Services may be limited or unavailable during periods of peak demand, market volatility, systems upgrade, maintenance, or for other reasons.

This site is designed for U. Learn more about our services for non-U. Unauthorized access is prohibited. Usage will be monitored. Expanded accounts panel with 5 nested items Overview Checking Account There are 1 nested list items FAQs Savings Account Home Loans There are 7 nested list items Today's Mortgage Rates Purchase a Home Refinance Your Mortgage Home Equity Line of Credit Mortgage Calculators Mortgage Process Start Your Loan Pledged Asset Line There are 1 nested list items PAL FAQs.

Find a branch Contact Us. You can do this in two ways: Select your online service with one of these buttons. Copy the URL in the box below to your preferred feed reader.

Long Iron Butterfly

Sharpen Your Trading Skills With Live Education Online Courses Local Workshops. Follow us on Twitter Schwab4Traders. Unlike traditional butterflies which can be created using calls or puts, iron butterflies are created using both calls and puts at the same time.

A short iron butterfly is a neutral strategy that has a limited loss potential if the underlying security moves sharply in either direction. An iron butterfly is considered "short" if a net credit is received when it is initiated: Schwab Center for Financial Research The options should all have the same expiration date and the strike range between the first and second leg should be the same as the strike range between the third and fourth leg.

Like many option strategies, the maximum gain, maximum loss, and breakeven points can all be calculated at the time of order entry. How to calculate price levels for a Short Iron Butterfly Assuming stock ZYX is trading at Example of a point short iron butterfly spread: Buy 5 ZYX Apr puts 5.

Please try again in a few minutes.

Schwab has tools to help you mentally prepare for trading. Talk trading with a Schwab specialist anytime. Call M-F, 8: Get Commission-Free Online Equity and Options Trades for Two Years. Important Disclosures Options carry a high level of risk and are not suitable for all investors.