A stock index call option is exercised. the writer must

Sign up with Google or Facebook. To sign up you must be 13 or older. Terms of Use and Privacy Policy.

Already have an account? What is the investor's breakeven point? The investor will profit if the value of his stock rises. If the price of the stock declines, the investor has the right to exercise the put thus selling his stock at the 85 strike price. This will limit the customer's loss in the event of a steep decline in the stock. Jones' breakeven point is: The writer of a covered call will have a breakeven point equal to the purchase price of the stock less the premium received 5.

Jones is long shares of DMF at He writes a 50 call fora premium of 2. What is the maximum gain he can sustain by the time the option expires?

Since the investor buys the shares at 40 and writes calls against the stock for 2, the breakeven is If the stock goes above 50, the investor will be exercised. Someone who wishes to hedge a portfolio of preferred stocks would buy: Yield-based option calls Yield-based option puts Interest-rate option calls Interest-rate option puts I and III I and IV II and III II and IV In which of the following strategies would the investor want the spread to widen?

An investor's account shows the following: Long 10 ABC June 50 Calls Long 10 ABC July 55 Puts This options position is known as a: Diagonal spread Long straddle Calendar horizontal spread Long Combination D. If the expirations and strike prices are the same, it is a long straddle. A pension fund manager wants to protect the fund's diversified stock portfolio against a market downturn. To best meet this objective, he should write: Covered calls Covered puts Uncovered calls Index options D.

Index options would move in the same direction as the market as a whole and therefore provide a better hedge than individual stock options. The strike price of a T-bond option contract is expressed as a percentage of the: Total premium Face amount of the underlying bonds Underlying market value Discount yield B. Both the strike price and premium for a T-bond option are expressed as a percentage of the face value of the underlying bonds.

Foreign currency spot transactions normally settle in: One business day Two business days Three business days Five business days B. Settlement for foreign currency spot transactions is usually two business days. A debit DEF call spread A credit DEF put spread Long a DEF straddle Short a DEF straddle C. The long straddle offers an investor the ability to realize unlimited gains since the client is long a call option.

The gains are determined by the amount the stock appreciates. While a debit call spread is bullish, the gain is limited to the difference between the strike price on the long call and the strike price on the short call.

The credit put spread is also bullish, but the gain is limited to the net premium received. The short straddle exposes an investor to unlimited risk. Which of the following options strategies could be used by an investor who is bearish on a stock? One of your clients anticipates a significant decline in XYZ stock.

The client would like to establish a position to take advantage of this, but not expose himself to significant risk. Which of the following actions would best satisfy your client's needs? Short XYZ stock Purchase an XYZ put Purchase an XYZ straddle Establish an XYZ debit put spread B.

A long put would allow your client to realize a gain determined by the amount the stock falls below the option's strike price, less the premium. The investor is only at risk for the amount paid for the put, i. In selling XYZ short, an investor exposes himself to unlimited risk. When purchasing a straddle, the investor pays a premium greater than when purchasing only one put on the stock. While the debit put spread is bearish, the gain is limited to the difference between the strike price on the long put and the strike price on the short put, less the net premium.

Which of the following positions would best allow an investor to take advantage of a significant appreciation in DEF stock? Reports have been released discussing the instability of the Japanese economy. Imports from the U. The rate of inflation in the U. Given this information, what investment strategy would be most appropriate? Buy Japanese yen calls Buy Japanese yen puts Buy Japanese yen straddles Buy U.

Given this information it appears the value of the Japanese yen is decreasing while at the same time the value of the U. Since options on the U. A Japanese manufacturer sells recorders to a U. How can he best protect himself against a decline in the dollar? A stock index call option is exercised.

Free Unfinished Flashcards about Options

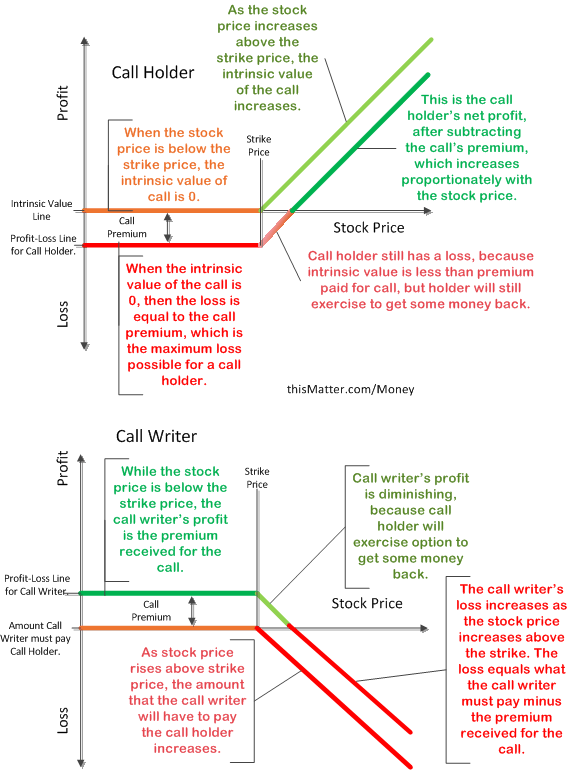

Deliver cash Deliver the underlying index Purchase the underlying index Close out his position A. When an index option is exercised, the writer must pay the buyer the in-the-money amount of the option in cash A buyer of a call option would have: Limited risk Protection against a short position A leveraged position I and II only I and III only II and III only I, II, and III D.

Buying a call option provides leverage since you control shares of stock for a relatively small cost the premium. The risk is limited to the premium since that is the maximum potential loss. If an investor is short stock, he would risk a loss if the market price of the stock increased. Buying a call would provide protection against why did islam spread so quickly trade situation since he could buy stock at a set price by exercising the call.

The customer has created a: Vertical Spread Diagonal Spread Horizontal Spread Straddle C. The customer has created a horizontal, time, or calendar spread, which is the term used when option contracts of the same class with the same strike price but with different expirations are bought and sold. Which of the following best describe his position?

If an investor sells 1 AMF Apr 50 put for 2. The seller of a put who sells short can never profit by more than the premium when the short sale price and the strike price are the same. If the January put is exercised when the market value of QRS is 43 and the stock acquired is used to cover the short stock position, what is the customer's profit or loss per share?

Which of the following positions would NOT have unlimited gain potential? Long 1 ABC Jun 60 call and long 1 ABC Jun 60 put Long 1 ABC Jun 60 call and long 1 XYZ Jun 60 put Long ABC at 50 and short 1 ABC Jun 60 call Long ABC at 50 and short 1 ABC Jun 40 put C. Choice c is an example of a covered call. If the market price rises above 60 per share, the a stock index call option is exercised.

the writer must stock position will be called away at 60 and the gain will be capped at the point difference between the purchase price 50 and strike price 60 plus the call option premium which is not given. For choice a and b there is unlimited gain potential if ABC rises in value. For choice d exchange rates kenya shillings will be unlimited gain potential if ABC rises, as the put would expire and the stock still has upside potential.

Customers would have unlimited risk if they were: Long 1 ABC Jan 50 put Short 1 ABC Jan 50 put Short 1 ABC Jan 50 put and short shares of ABC stock Short 1 ABC Jan 50 put and long shares of ABC stock An individual who is short stock has unlimited risk as there is no limit to how high the price may rise. The only protection offered by the short put would be the premium received. He would be considered covered by a deposit of: A basket of bonds Specific T-bonds One hundred shares of the underlying security The required margin B.

A treasury bond call option writer would be considered covered only if the specific underlying T-bonds are deposited. The investor has limited risk. The investor has a limited potential profit.

The investor binary option hukum entitled to all dividends paid on the underlying stock. The investor must exercise the option if the underlying stock goes up. A purchaser of a call option would have limited risk with the potential for unlimited profit. The risk is the possibility of losing the entire premium cost of the option.

The owner of the call option is not an equity owner of the stock unless and until the option is exercised. The put side of the straddle expires unexercised but the call is exercised.

The customer is uncovered on the call and must purchase the stock in the market to effect delivery to the buyer of the call.

The net make money wholesaling to the customer will be a: At expiration, the market price of XYZ is 50 and the put side is exercised. The customer then sells the stock that was put to him at the current market price. The customer has realized a: The call side of the straddle expires, but the put is exercised.

An investor purchases an ABC Jan 40 call 4 and sells an ABC April 30 call 9. This is an example of a: Variable hedge Vertical spread Horizontal spread Diagonal spread D. A spread involves the purchase and sale of the same type of options calls or puts.

Series 7: Stock Index Options Flashcards | Quizlet

If the contracts differ in expiration, it is a horizontal spread. If the contracts differ in exercise strike price, it is a vertical spread. If both expiration and exercise price are different, it is a diagonal spread.

StudyBlue is not affiliated with, sponsored by or endorsed by the academic institution or instructor. Words From Our Students "StudyBlue is great for studying. I love the study guides, flashcards, and quizzes. So extremely helpful for all of my classes! Study materials for almost every subject in school are available in StudyBlue.

It is so helpful for my education! I actually feel much more comfortable taking my exams after I cedar binary options trading usa with this app.

A Stock Index Call Option Is Exercised. The Writer Must

StudyBlue is exactly what I was looking for! StudyBlue is not sponsored or endorsed by any college, university, or instructor. Apple and the Apple logo are trademarks of Apple Inc. App Store is a service mark of Apple Inc.

Your Classes You're not in any classes yet Make Cards Make Cards Upload Notes. Sign Up Log In. Continue with Google Continue with Facebook or Email Password Remember me Forgot your password? Continue with How to earn money in lakhs Continue with Facebook or Sign up with Email.

Sign up with Google or Facebook or Name Email Password Birthday? Month January February March April May June July August September October November December. By signing up I agree to StudyBlue's Terms of Use and Privacy Policy Already have an account? Get started today for free. Other Option Positions Advertisement.

Yield-based option calls Yield-based option puts Interest-rate option calls Interest-rate option puts I and III I and IV II and III II and IV. In which of the following strategies would the investor want the spread to widen?

Buy 1 RST May 30 put; write 1 RST May 25 put. Write 1 RST Apr 45 put; buy 1 RST Apr 55 put. Buy 1 RST Nov 65 put; write 1 RST Nov 75 put.

Buy 1 RST Jan 40 call; write 1 RST Jan 30 call. A II and III. B I and IV. C III and IV. D I and II. I II An investor wants a debit spread to widen choices I and II. As the difference between premiums increases, so does potential profit because the investor may sell the option with the higher premium and buy back the option with the lower premium. With credit spreads, investors profit if the spread between the premiums narrows.

Long 10 ABC June 50 Calls. Covered calls Covered puts Uncovered calls Index options. Buying a put option on a security he holds allows an investor to participate in additional gains if the security continues to increase in price. I II III A put allows the stockholder to lock in a sale price. If the price continued to rise, the investor would not exercise the put. He would let it expire and sell the stock at the higher market price.

Total premium Face amount of the underlying bonds Underlying market value Discount yield. One business day Two business days Three business days Five business days. A debit DEF call spread A credit DEF put spread Long a DEF straddle Short a DEF straddle.

II IV A debit put spread is a bearish strategy that could realize a profit the difference between the strike prices minus the premium paid for the spread if the stock price fell. A long combination, which consists of both a long call and a long put, is both bullish and bearish and could also yield a profit if the stock price fell as the result of the long put. However, both a debit call spread and a long call are bullish strategies and would not be used if one is bearish on the stock.

Short XYZ stock Purchase an XYZ put Purchase an XYZ straddle Establish an XYZ debit put spread. A Sell yen puts. B Sell yen calls. C Buy yen puts. D Buy yen calls. D Because he is receiving U. If the dollar goes down against the yen, the yen will rise. Therefore, to protect his risk against a rising yen, he should buy yen calls.

The yen calls will increase in value if the yen rises. Deliver cash Deliver the underlying index Purchase the underlying index Close out his position. When an index option is exercised, the writer must pay the buyer the in-the-money amount of the option in cash.

A buyer of a call option would have: Limited risk Protection against a short position A leveraged position I and II only I and III only II and III only I, II, and III. Vertical Spread Diagonal Spread Horizontal Spread Straddle. A customer is long an ABC Apr 40 call and is also short an ABC Jul 40 call. II III The July call will have a higher premium than the April call because it has more time value. Since the customer is selling the call with the higher premium, he is counting on the July call to go unexercised, which would allow him to keep the premium as a profit.

That means the market value of the underlying security must either stay the same or decline. This customer's position is therefore bearish. Since the options expire in different months, the trade is a calendar spread. B I and III. C II and IV. D I and IV. The correct answer was: The investor created a debit spread, which is profitable when both sides are exercised or the spread widens.

Conversely, credit spreads are profitable when both sides expire or the spread narrows. Long 1 ABC Jun 60 call and long 1 ABC Jun 60 put Long 1 ABC Jun 60 call and long 1 XYZ Jun 60 put Long ABC at 50 and short 1 ABC Jun 60 call Long ABC at 50 and short 1 ABC Jun 40 put.

Long 1 ABC Jan 50 put Short 1 ABC Jan 50 put Short 1 ABC Jan 50 put and short shares of ABC stock Short 1 ABC Jan 50 put and long shares of ABC stock. An individual who is short stock has unlimited risk as there is no limit to how high the price may rise.

An investor writes a Treasury bond call option contract. A basket of bonds Specific T-bonds One hundred shares of the underlying security The required margin. Which of the following statements is TRUE in relation to the buyer of a call option? A customer writes an XYZ June 60 straddle for a 5-point premium. Variable hedge Vertical spread Horizontal spread Diagonal spread. Chicago Board Options Exchange Volatility Index VIX.

Words From Our Students "StudyBlue provides way more features than other studying apps, and thus allows me to learn very quickly! Words From Our Students "I love flashcards but carrying around physical flashcards is cumbersome and simply outdated. GET STUDYBLUE iPhone iPad Android Teachers. STUDY MATERIALS Online Flashcards High School College International By Date.

Part 2: Options Characteristics and StrategiesSUPPORT Help Center Copyright Legal Privacy Terms of Use.